MaxYield Checking & Savings

MaxYield Checking & Savings is designed to give members more of what matters—higher earnings, fewer fees, and everyday convenience. By pairing a high‑yield savings account with the flexibility of checking, this package helps you grow your balance effortlessly while still having full access to your money.

Step into more benefits with a smarter way to save and spend

MaxYield Checking & Savings is more than an account—it’s a way to feel confident about your financial future. Whether you’re saving for something big or simply want your everyday banking to work harder for you, MaxYield gives you the freedom to grow at your own pace. With higher earnings, fewer fees, and perks that reward your relationship with CoVantage, you can enjoy a banking experience that feels supportive, simple, and built around your goals.

Why Members Choose MaxYield

High‑Yield Savings That Works for You

-

Earn 3.25% APY on your primary savings balance¹

-

No minimum balance requirements

-

No maximums—your full balance earns the same great rate

-

No monthly account fees

Exclusive Member Perks

-

Access our best available savings and certificate rates

-

Enjoy discounted loan rates on eligible loans²

-

Get paid sooner with direct deposit up to two days early³

Everyday Banking Made Easy

-

Free digital banking with MyCoVantage

-

Mobile check deposit, bill pay, and account alerts

-

Access to 30,000+ surcharge‑free ATMs

-

Friendly, local support whenever you need it

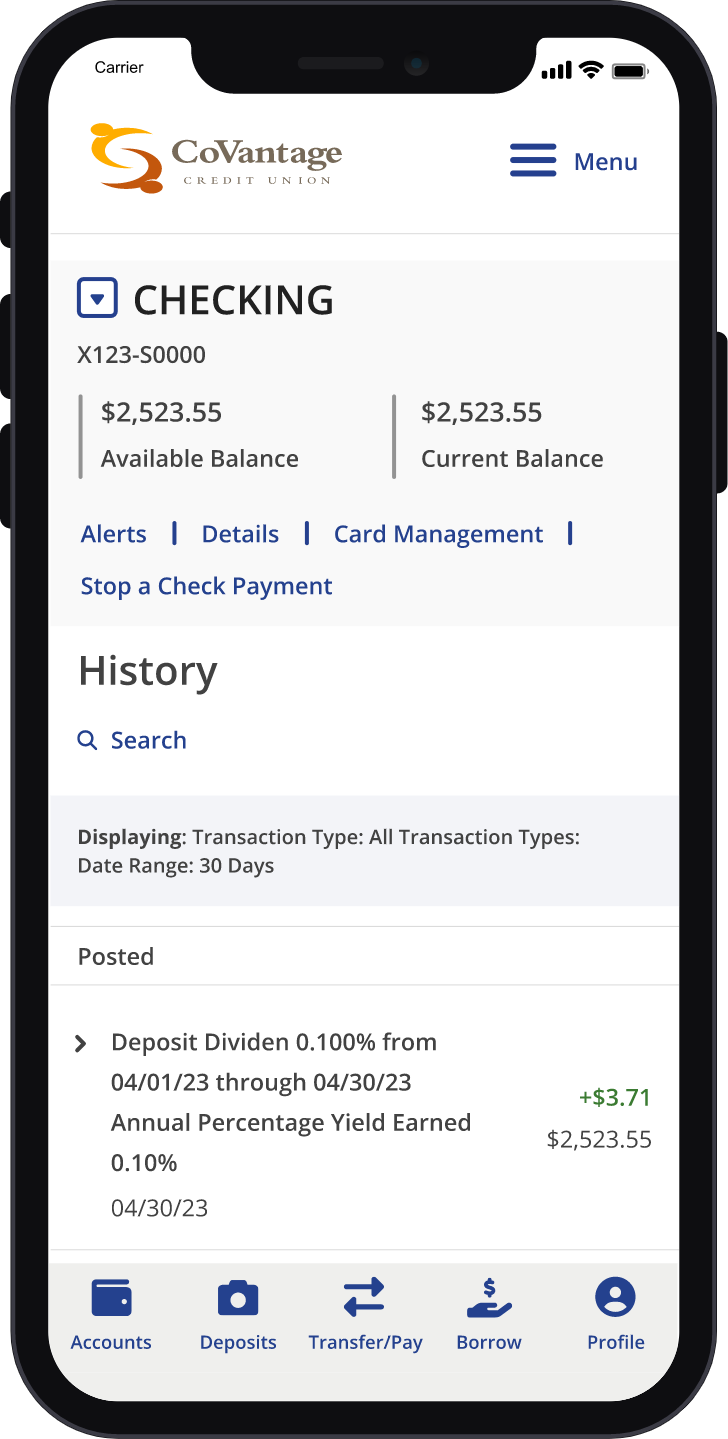

Banking on-the-go is effortless and fee-free!

With our user-friendly mobile app, your banking needs are just a tap away. Access your MaxYield Checking & Savings anytime, anywhere, and take advantage of these exceptional features: Mobile Check Deposit, Real-Time Balances, Bill Pay, and more!

How to Qualify for MaxYield Checking & Savings

To unlock the highest savings rate and exclusive perks, simply complete these three steps each month:

-

Maintain a CoVantage checking account

-

Set up an eligible direct deposit⁴

-

Use your CoVantage debit or credit card for at least four transactions per month

That’s it—no hoops, no hidden requirements.

13.25% APY (annual percentage yield) effective 3/1/2026 and may change without notice. Rate is applied to the primary membership share savings account.

2Loan rate discounts apply to consumer loans (secured and unsecured personal and vehicle/RV). All loans are subject to CoVantage's normal credit requirements.3Eligible members may receive direct deposit funds up to two days early, depending on when the payment file is received from the payer. Early availability is not guaranteed and may vary by pay period.

4Eligible direct deposits are either electronic payroll or federal payments (i.e. social security); OR $1000 or more in deposits per month. Members aged 12-22 are exempt from direct deposit requirement.

See CoVantagecu.org for full details. Federally insured by NCUA.