Checking

Shake loose from hidden fees that slow you down and connect to a checking account that lets you manage money the way you want.

Checking that's free of hidden fees and full of perks

Everybody needs a good checking account, but we don't think anyone deserves the restrictions that come with so many accounts out there. Instead of offering multiple checking accounts with tiers, fees, and confusing packages, CoVantage Credit Union offers just one type of checking account for all eligible members in Wisconsin, Michigan, Illinois and beyond.

Our checking account has no minimum balance requirement, no overdraft fees, no insufficient funds or courtesy pay fees, no automatic savings transfer fees, and no monthly fee with paperless statements.

Your daily debit card transactions are rounded up to the next whole dollar. All rounded-up amounts from debit card purchases are automatically transferred in one lump sum from your checking to savings at the end of each day.*

Your checking balance can dip below zero without you knowing it. No one wants that to happen. Kwik Cash Overdraft Protection is a line of credit linked to CoVantage checking accounts. If you make a transaction that's bigger than your balance, we automatically lend you the needed money.**

It's a convenient way to make purchases and there is never a transaction fee. And an easy way to make a profit. The more you use your CoVantage Visa® debit card, the more cold, hard cash we'll put back in your pocket.

Checking & Savings Account Rates

| Product | Rate | APY | Minimum Deposit |

|---|---|---|---|

| Savings | 0.245% | 0.250% | $10.00 Minimum. Dividend computed on daily balance and credited to account monthly. |

| Misc. Savings | 0.245% | 0.250% | $10.00 Minimum. Dividend computed on daily balance and credited to account monthly. |

| Christmas Club | 0.245% | 0.250% | $10.00 Minimum. Dividend computed on daily balance and credited to account monthly. Account balance is paid out 10/31. |

| Checking | 0.100% | 0.100% | Dividend credited to account monthly. Account must maintain a minimum daily balance of $500.00 to earn a dividend. |

| IRA Account | 0.245% | 0.250% | $10.00 Minimum. Dividend computed on daily balance and credited to account monthly. |

| Funeral Account | 0.245% | 0.250% | $10.00 Minimum. Dividend computed on daily balance and credited to account monthly. |

Enjoy surcharge-free ATM withdrawals at over 30,000 locations that are part of the nationwide Alliance One or CO-OP Networks. There’s almost certainly an ATM near you in Wisconsin, Michigan, or Illinois. We also offer virtual teller assistance at many of our locations, so you can perform your normal teller transactions even when the branch is closed! To experience the full benefits of the Virtual Teller ATMs, you will need a CoVantage Visa® debit card.

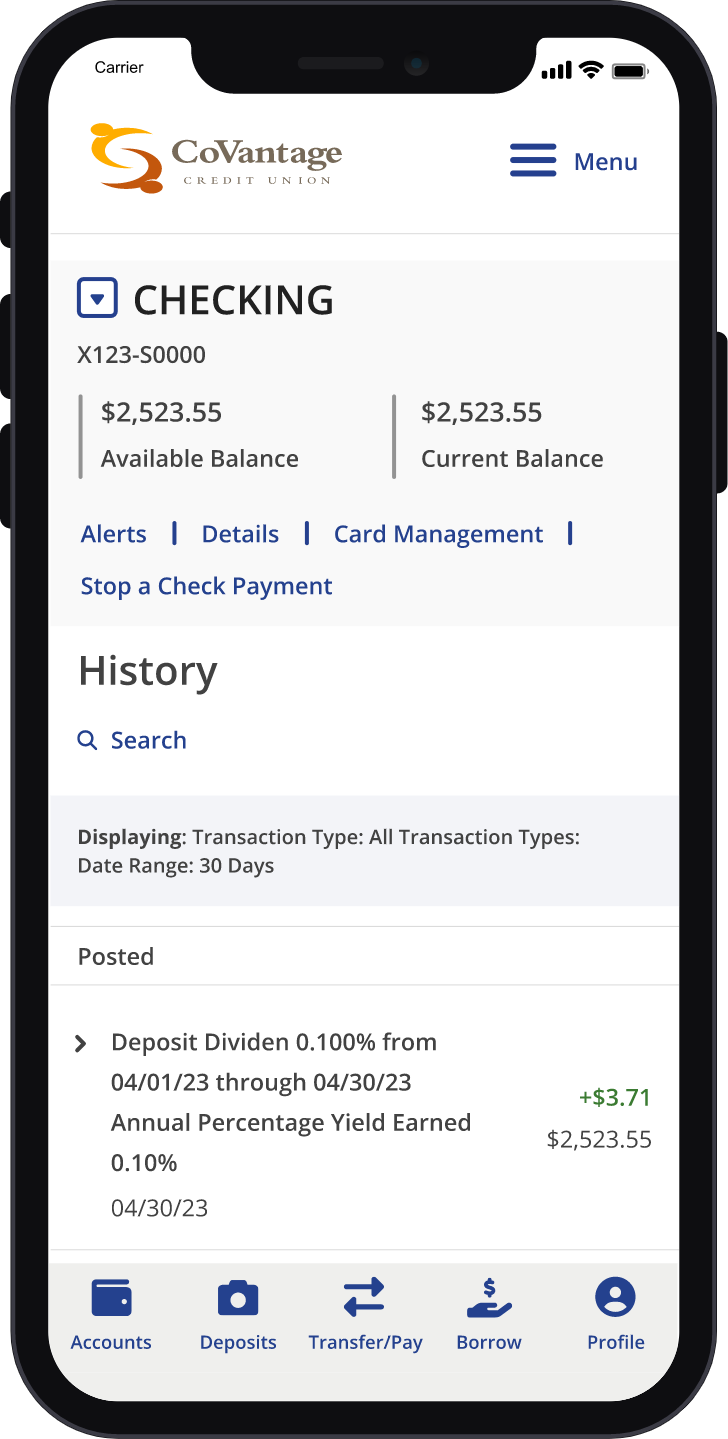

Banking on-the-go is effortless and fee-free!

With our user-friendly mobile app, your banking needs are just a tap away. Access your MaxYield Checking & Savings anytime, anywhere, and take advantage of these exceptional features: Mobile Check Deposit, Real-Time Balances, Bill Pay, and more!

Additional Resources

Keep Your Money Safe in 6 Easy Steps

- February 16, 2024

- Lindsey Mueller, Community Outreach Officer

The 10 Budgeting Basics

- February 16, 2024

- Lindsey Mueller, Community Outreach Officer

Change It Up Debit Card Automatic Saving Program Eligibility

The member must have an open and active CoVantage Visa debit card, CoVantage checking account, and a membership share (savings) account to be eligible for Change It Up debit card automatic savings program.

Enrollment

A member may enroll/unenroll in Change It Up at any time in MyCoVantage or may enroll/unenroll in the program with a Member Specialist at any branch or over the phone. Participation in the program is at the account level, which means all debit card associated with the checking account will be part of the program. You cannot enroll or remove individual debit cards associated with your checking account. If you enroll and later receive a new debit card due to your card being lost, stolen, or reissued, your participation in the program will continue.

How it works

Following the member's enrollment in the program, each purchase made by the member with his or her CoVantage Visa debit card will be rounded up to the nearest whole U.S. dollar. The round up amount (between $0.01 and $0.99) will then be transferred from the member's checking account balance to the member's savings account balance. This transfer is referred to as a " Change It Up Transfer."

Annually, CoVantage Credit Union will pay the account holder 5% of the total of all rounded amounts. These funds will be automatically deposited into the membership share (savings) account on December 31. All matched rewards will be considered taxable income and will be reported to the Internal Revenue Service. The matching funds from CoVantage will be included on the tax form with the regular dividends earned. Matching funds are paid on accounts in good standing that remain open, enrolled, and have a positive balance. Matching funds only apply to Change It Up transfers and do not include any deposits made to a member’s savings account outside of the program. The match percentage amount is subject to change annually.

What is a qualifying purchase? Any card-present signature purchase or Personal Identification Number (PIN) purchase transaction made using a CoVantage Visa debit card. What is not a qualifying purchase? Any cash withdrawal from an ATM or over-the-counter cash withdrawal; bill payment transactions using MyCoVantage; cash back received at a point-of-sale device; MyCoVantage online transfers between checking and savings; and electronic one-time or recurring ACH debit transactions.

Transfer Timing

CoVantage Credit Union will aggregate the round-up from CoVantage Visa debit card purchases that post to your checking account each day and make a single transfer to the savings account the following day. Transfers will only take place if a member has a checking balance of at least $50, prior to the transfer occurring. If a transfer is cancelled on a certain day because of the minimum balance requirement, Change It Up transfers will resume on the next day that balances in the member’s checking are over $50.

Exceptions

- A Change It Up transfer will not be made if a purchase transaction consists of a whole dollar amount, e.g., $5.00.

- If a member's purchase is canceled or reversed for any reason (including disputes), the corresponding Change It Up transfer will not be reversed.

- Load n'Go, HSA, and business debit cards cannot be enrolled in the Change It Up program.

Enrolled CoVantage debit cards, checking accounts and savings accounts will be subject to all existing requirements and limitations for accounts of that type. CoVantage Credit Union reserves the right to cancel or modify the Change It Up debit card automatic savings program, or terminate the member's eligibility, at any time with or without prior notice.

- Fees and categories of transactions: CoVantage does not charge overdraft or NSF fees. There is no fee for the payment of each overdraft, regardless of the overdraft transaction type.

- Repayment Timeframe: You must repay or cover any overdraft within 21 calendar days to avoid account restrictions or closure.

- Non-Payment Circumstances: Whether your overdrafts will be paid is discretionary, and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is not in good standing, or you are not making regular deposits, or you have too many overdrafts.