Breakdown of a Credit Score

You’ve likely heard about credit scores before (thanks to all those commercials with terrible jingles), but what do you actually know about them? How long have they been around? And what’s the deal with checking them?

Credit Score Breakdown

CREDIT SQUIRREL: Excuse me. What do you know about credit scores?

JEN: Hmmm. Not very much. Also, who said that?

CREDIT SQUIRREL: I did. Do you know what a good credit score is?

JEN: Uh, twelve?

CREDIT SQUIRREL: No.

JEN: A hundred.

CREDIT SQUIRREL: No.

JEN: Four… out of five.

CREDIT SQUIRREL: No. Allow me to explain. A credit score is a three digit number that's calculated by credit bureaus and gives banks, credit unions and landlords an idea of how likely you are to pay your loan or rent on time. Most scores are between 300 and 850.

JEN: But the higher the better, right? I always like to score as many points as possible.

CREDIT SQUIRREL: Excellent. Having a low score means you could be turned down for a loan. And if you're somewhere in the middle…

JEN: You still get the loan?

CREDIT SQUIRREL: Sometimes, but you'll have to pay more interest, and that's not good because it will cost you more in the long run.

JEN: So what goes into a credit score, Credit Squirrel?

CREDIT SQUIRREL: I'm glad you asked. Each credit bureau has its own calculation, but it basically goes like this: 35% is based on payment history. If you make payments on time, it's good. 30% is based on capacity. This shows how much of your available credit is being used. If you're close to maxing out the credit limit on your credit cards or other lines of credit, it's not good. Even if you’ve been making regular payments on time. 15% is based on length of credit. The longer that you've been using credit, the clearer the snapshot of your credit habits. This is your credit history. 10% is based on new credit. If you open lots of credit cards or loans in a short amount of time, you look risky. Lastly, another 10% is based on the types of credit you use. This is your mix of credit cards including retail store cards, bank and credit union cards, plus student and auto loans and mortgages. And that my friend is the breakdown of a credit score.

JEN: Thanks Credit Squirrel. That was very helpful.

CREDIT SQUIRREL: Do you have any more questions for me?

JEN: Yes. How do you know all this and also how come you can talk? Thanks Credit Squirrel!

JEN: Oh look. Credit Squirrel forgot his tiny hat. Boop.

Breakdown of a Credit Score

It's a Money Thing

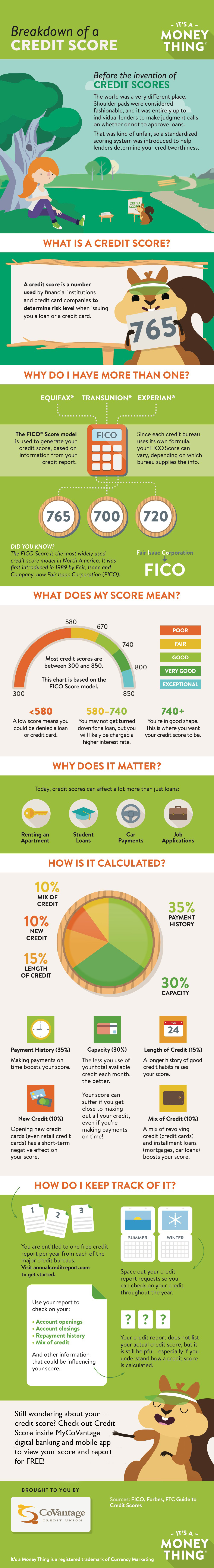

Before the invention of credit scores

The world was a very different place. Shoulder pads were considered fashionable, and it was entirely up to individual lenders to make judgement calls on whether or not to approve loans. That was kind of unfair, so a standardized scoring system was introduced to help lenders determine your creditworthiness.

What is a Credit Score?

A credit score is a number used by financial institutions and credit card companies to determine risk level when issuing you a loan or a credit card.

Why Do I Have More Than One?

Equifax, TransUnion, Experian

The FICO model is used to generate your credit score, based on information from your credit report. Since every credit bureau uses its own formula, your FICO score can vary, depending on which bureau supplies the info.

765, 700, 720

Did You Know?

The FICO score is the most widely used credit score model in North America. It was first introduced in 1989 by Fair, Isaac and Company, now Fair Isaac Corporation (FICO).

What Does My Score Mean?

Most credit scores are between 350 and 800.

<550 (Low): A low score means you could be denied a loan or credit card.

550 - 720 (the middle): You may not get turned down for a loan in this range, but you will likely be charged a higher interest rate.

720+ (Prime): You're in good shape. This is where you want your credit score to be.

Why Does It Matter?

Today, credit scores can affect a lot more than just loans:

Renting an apartment, student loans, car payments, job applications

How Is It Calculated?

10% mix of credit

10% new credit

15% length of credit

35% payment history

30% capacity

Payment History (35%): Making payments on time boosts your score.

Capacity (30%): The less you use your total available credit each month, the better. Your score can suffer if you get close to maxing out all your credit, even if you're making payments on time!

Length of Credit (15%): A longer history of good credit habits raises your score.

New Credit (10%): Opening new credit cards (even retail credit cards) has a short-term negative effect on your credit score.

Mix of Credit (10%): A mix of revolving credit (credit cards) and installment loans (mortgages, car loans) boosts your score.

How Do I Keep Track Of It?

You are entitled to one free credit report per year from each of the major credit bureaus. Visit annualcreditreport.com to get started.

Space out your credit report requests so you can check on your credit throughout the year.

Use your report to check on your:

Account openings, account closings, repayment history, mix of credit and other information that could be influencing your score. Your credit report does not list your actual credit score, but it is still helpful - especially if you understand how a credit score is calculated.

Stil curious about your credit score? You can access your score through Credit Score inside MyCoVantage for free!

Brought to you by CoVantage Credit Union

Sources: FICO, Forbes, FTC Guide to Credit Scores

It's a Money Thing is a registered trademark of Currency Marketing