Budgeting Basics

Budgets are like the New Year’s resolutions of personal finance. We all know we should have one and we all know it’s a fairly simple thing to follow—at least in theory. Like resolutions, we often map out personal budgets with the best of intentions, only to abandon them a couple of weeks later.

Budgeting Basics

JEN: Fortune teller? Ah, sweet, I can't pass up a good deal.

LUNA: Come in, come in. Cross my palm with silver to unlock the secrets of eternal prosperity.

JEN: Um?

LUNA: It's twenty bucks, kid.

JEN: What? I mean, of course. I thought this was supposed to be a cheaper place?

LUNA: I sense… I sense your name is

JEN: Jen?

LUNA: Jen!

JEN: Wow.

LUNA: And you appear to be a plumber?

JEN: Nope

LUNA: But there is more than meets the eye! For you have some sort of… part-time job?

JEN: Yes…

LUNA: Great! So then you have a regular pay check coming in. Draw a card, Jen. Choose wisely.

JEN: Oh no! What does it mean?

LUNA: Oh that's just car insurance. That's usually an annual one so that goes over here. Draw another. Oh my! With that card I sense a powerful energy here.

JEN: The utilities card? Wait a second. Utilities, income, expenses… are you budgeting me?

LUNA: Well, yeah.

JEN: I thought you read fortunes.

LUNA: You won't have any fortune left for me to read unless you know how much you spend versus how much you earn. Your income is actually less than your paycheck or salary. When planning a budget, you must factor in taxes and deductions, otherwise you will be budgeting money you don't even have.

JEN: But budgeting is mostly for saving up for big stuff, right? I pay my rent and Internet and I still have money leftover, so I'm good.

LUNA: How do you know what you can and can't afford?

JEN: Well, I look at my account balance, and if there's money there I know I can spend it.

LUNA: Your palm! Show me your palm.

JEN: Palm reading? Now we're talking. Ow!

LUNA: No more spending until you give every dollar a job! Part of that account balance that you're freely spending on fun stuff should actually be going to savings and one-time payments. Budgeting doesn't mean feeling guilty for fun purchases, it means feeling confident about them.

JEN: Like being in control of your own destiny!

LUNA: Sure… look! My crystal ball!

JEN: What do you see?

LUNA: It's… it's a warning. An unforeseen circumstance. An emergency of some sort!

JEN: Oh no!

LUNA: It is unavoidable, Jen. If you do not prepare yourself, it will cost your dearly.

JEN: That sounds horrible! What is it? An accident?

LUNA: It could be. Or just like, your car doesn't start one morning or there's a loss of income in your household or something like that.

JEN: Oh this is a budgeting thing again.

LUNA: An emergency fund is an important part of your budget!

JEN: It's cool, I get it.

LUNA: Are you sure? Because I predict many more sessions for you with the Budget Fortune Teller at a very reasonable rate.

JEN: No, I think I got it. Budgeting is about control, I need to be real about my income and watch out for sneaky expenses and savings and emergency funds are important. Great!

LUNA: But the crystal ball told me! I foresee at least seven to eight more sessions! Luna has bills to pay, too! Hey!

JEN: This is so pretty.

LUNA: Why thank you! I've had it for years, it's… oops!

JEN: I bet you didn't foresee that emergency expense!

Budgeting Basics: It's a Money Thing

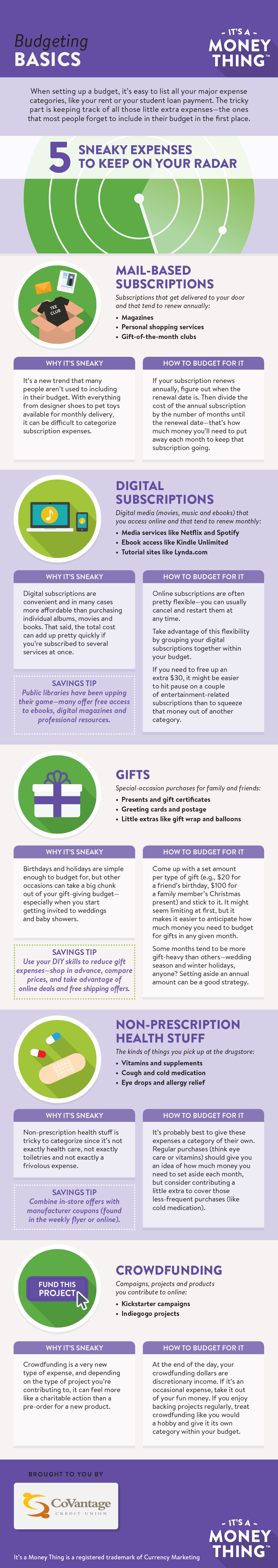

When setting up a budget, it's easy to list all your major expense categories, like your rent or your student loan payment. The tricky part is keeping track of all those little extra expenses - the ones that most people forget to include in their budget in the first place.

5 Sneaky Expenses To Keep On Your Radar

Mail-based Subscriptions

Subscriptions that get delivered to your door that tend to renew annually:

- Magazines

- Personal shopping services

- Gift-of-the-month clubs

Why It's Sneaky

It's a new trend that many people aren't used to including in their budget. With everything from designer shoes to pet toys available for monthly delivery, it can be difficult to categorize subscription expenses.

How To Budget For It

If your subscription renews annually, figure out when the renewal date is. Then divide the cost of the annual subscription by the number of months until the renewal date - that's how much money you'll need to put away each month to keep that subscription going.

Digital Subscriptions

Digital media (movies, music and ebooks) that you access online and that tend to renew monthly:

- Media services like Netflix and Spotify

- Ebook access like Kindle Unlimited

- Tutorial sites like Lynda.com

Why It's Sneaky

Digital subscriptions are convenient and in many cases more affordable than purchasing individual albums, movies and books. That said, the total cost can add up pretty quickly if you're subscribed to several services at once.

Savings Tip

Public libraries have been upping their game - many offer free access to ebooks, digital magazines and professional resources.

How To Budget For It

Online subscriptions are often pretty flexible - you can usually cancel and restart them at any time. Take advantage of this flexibility by grouping your digital subscriptions together within your budget. If you need to free up an extra $30, it might be easier to hit pause on a couple of entertainment-related subscriptions than to squeeze that money out of another category.

Gifts

Special-occasion purchases for family and friends:

- Presents and gift certificates

- Greeting cards and postage

- Little extras like gift wrap and balloons

Why It's Sneaky

Birthdays and holidays are simple enough to budget for, but other occasions can take a big chunk out of your gift-giving budget - especially when you start getting invited to weddings and baby showers.

Savings Tip

Use your DIY skills to reduce gift expenses - shop in advance, compare prices, and take advantage of online deals and free shipping offers.

How To Budget For It

Come up with a set amount per type of gift (e.g., $20 for a friends birthday, $100 for a family member's Christmas present) and stick to it. It might seem limiting at first, but it makes it easier to anticipate how much money you need to budget for gifts in any given month. Some months tend to be more gift-heavy than others - wedding season and winter holidays, anyone? Setting aside an annual amount can be a good strategy.

Non-Prescription Health Stuff

The kinds of things you pick up at the drugstore:

- Vitamins and supplements

- Cough and cold medication

- Eye drops and allergy relief

Why It's Sneaky

Non-prescription health stuff is not tricky to categorize since it's not exactly heath care, not exactly toiletries and not exactly a frivolous expense.

Savings Tip

Combine in-store offers with manufacturer coupons (found in the weekly flyer or online).

How To Budget For It

It's probably best to give these expenses a category of their own. Regular purchases (think eye care or vitamins) should give you an idea of how much money you need to set aside each month, but consider contributing a little extra to cover those less-frequent purchases (like cold medication).

Fund this project

Crowdfunding

Campaigns, projects and products you contribute to online:

- Kickstarter campaigns

- Indiegogo projects

Why It's Sneaky

Crowdfunding is a very new type of expense, and depending on the type of project you're contributing to, it can feel more like a charitable action than a pre-order for a new product.

Brought To You By CoVantage Credit Union

It's a Money Thing is a registered trademark of Currency Marketing