Foiling Identity Theft

Styled quote: Identity theft is nothing new, and yet it still manages to cost its victims billions of dollars (yes, that’s billions with a “b”) globally each year—not to mention the time and hassle involved in recovering a stolen identity.

Foiling Identity Theft

CHIEF: Welcome to NPYIS, Jen.

JEN: NP-what, now?

CHIEF: NPYIS. Not Protecting Your Identity Super-Good. You're just in time. This is our crime scene.

JEN: No, that's my apartment?!

CHIEF: It's a goldmine for identity thieves.

JEN: I know I should probably be more concerned about the camera in my apartment right now, but for the sake of learning more about identity theft… What? How?

CHIEF: Look here. Trash can… enhance! Mail with your full name and address, old bank statements, an expired credit card. These need to be shredded beyond recognition before they get thrown out or someone could scoop your identity out of a recycling bin.

JEN: Oh man! I didn't realize that.

CHIEF: Not many people do. And look here. Wallet… enhance! Do you really need to carry all that stuff with you every day?

JEN: Well, no. I just kinda keep it there.

CHIEF: Ahhh. Anything needlessly in your wallet can be needlessly stolen. Carry the bare minimum with you and store the rest in a secure place. Hmmm… smart phone enhance! Phones in the wrong hands are a portal to your personal information. Passcode protect them or use an app that will wipe the phone if it gets lost or stolen. And don't store pin-codes or passwords in to-do list apps.

JEN: But they're so handy!

CHIEF: Well they're handy for identity thieves, too. So are your social media posts. Don't over share, don't broadcast when you're going out of town, and don't post photos of latte art.

JEN: Latte art. Why?

CHIEF: Because I'm sick of seeing them in my newsfeed!

JEN: Oh.

AGENT: Sir, coffee shop surveillance. Just came in.

CHIEF: Hmm. During transactions, keep your card in sight at all times and use your hand to cover your pin number. And things like banking and online shopping should never be done from a public wifi network.

JEN: Gotcha.

CHIEF: Let's check out your work station. Computer enhance! It looks like you only shop on trusted sites. That's good. Good job. Web browser, enhance, enhance, enhance, enhance! That's better. When entering personal information online, look for https and that padlock symbol. It means it's secure. Email enhance! Look out for suspicious-looking emails and links. Thieves will pose as large companies and ask for personal information hoping you won't notice the difference. Sketchy email addresses and URLs can give them away.

JEN: Cool.

CHIEF: Install spam filters and anti-virus software to protect yourself from these instances. Emails are not secure, so you should never send personal information by email. And, of course, never use the same password for everything.

AGENT: Sir, results are back from the lab. She uses the same password for everything.

CHIEF: If you can't do it yourself, then you can use a trusted, secure password manager app to do it for you.

JEN: Well if I didn't need it before, I definitely need it now.

CHIEF: All right. What's that there? Kitty cat, enhance!

JEN: Hey! My cat is not an identity thief.

CHIEF: I know. I'm just investigating how cute it is. Ahh… adorable. Vigilance is also an important part of keeping your identity safe. Familiarize yourself with your billing cycles so that you can tell if a statement doesn't show up or your mail gets tampered with.

AGENT: Sir, this just came in. Identity theft reported. Phone scam. Fake contest for a cruise.

CHIEF: I'm on it.

JEN: Computer enhance. Ahh… so cool. Enhance!

CHIEF: This is my cat Smokey. And this over here is Mittens. This is my cat Bella. She's allergic to pineapple.

Foiling Identity Theft

It's a Money Thing

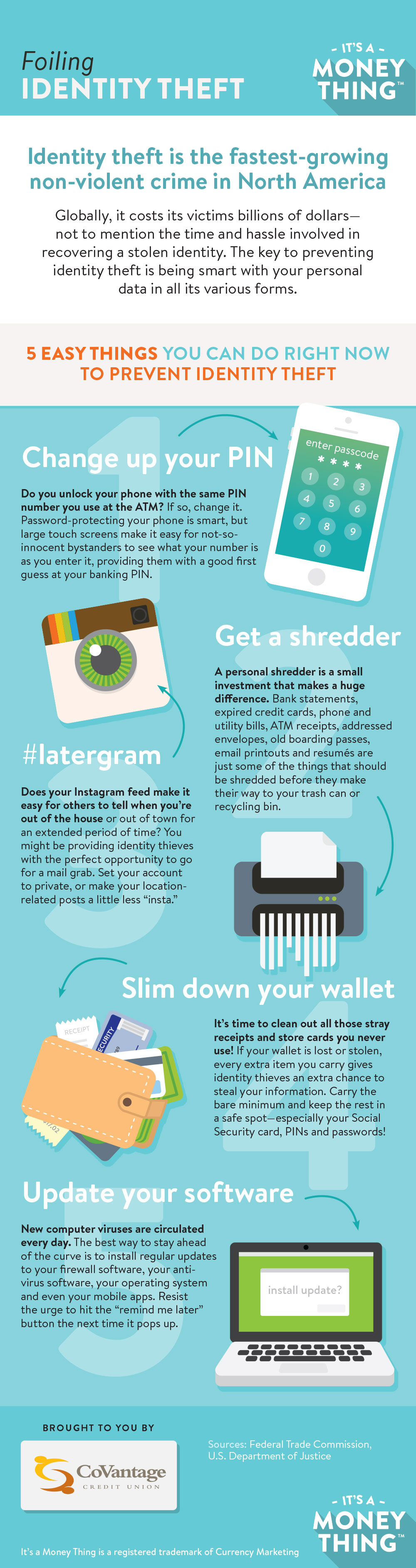

Identity theft is the fastest-growing non-violent crime in North America. Globally, it costs its victims billions of dollars - not to mention the time and hassle involved in recovering a stolen identity. The key to preventing identity theft is being smart with your personal data in all its various forms.

5 Things You Can Do Right Now To Prevent Identity Theft

Change up your PIN

Do you unlock your phone with the same PIN number you use at the ATM? If so, change it. Password-protecting your phone is smart, but large touch screens make it easy for not-so-innocent bystanders to see what your number is as you enter it, providing them with a good first guess at your banking PIN.

Get a shredder

A personal shredder is a small investment that makes a huge difference. Bank statements, expired credit cards, phone and utility bills, ATM receipts, addressed envelopes, old boarding passes, email printouts and resumes are just some of the things that should be shredded before they make their way to your trash or recycling bin.

#latergram

Does your Instagram feed make it easy for others to tell when you're out of the house or out of town for an extended period of time? You might be providing identity thieves with the perfect opportunity to go for a mail grab. Set your account to private, or make your location-related posts a little less "insta".

Slim down your wallet

It's time to clean out all those stray receipts and store cards you never use! If your wallet is lost or stolen, every extra item you carry gives identity thieves an extra chance to steal your information. Carry the bare minimum and keep the rest in a safe spot - especially your Social Security card, PINs and passwords!

Update your software

New computer viruses are circulated every day. The best way to stay ahead of the curve is to install regular updates to your firewall software, your anti-virus software, your operating system and even your mobile apps. Resist the urge to hit the "remind me later" button the next time it pops up.

Brought to you by CoVantage Credit Union

Sources: Federal Trade Commission, U.S. Department of Justice

It's a Money Thing is a registered trademark of Currency Marketing